Management Liability – Protect your people

Management liability – Protecting your people

It doesn’t matter whether you’re the director of a start-up, non-profit or FTSE100 listed firm, the day-to-day decisions you make, could leave you vulnerable to legal action. Not only that, your employees and even the business itself, are also subject to scrutiny and claims can also be made against them.

However, you can protect your actions and those of your staff and organisation with management liability insurance, here’s what it covers and how it can help your business.

What is management liability insurance?

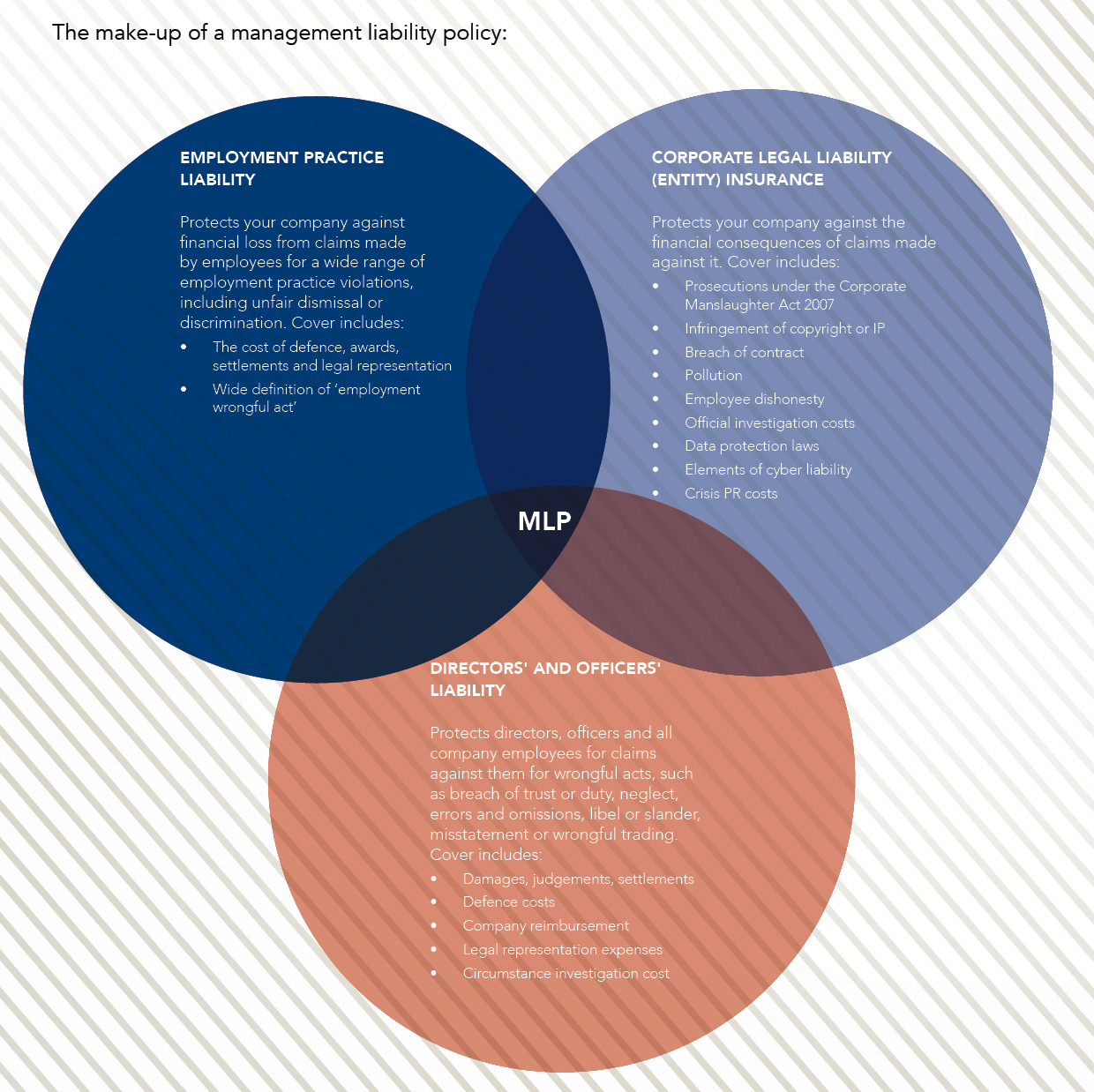

Management liability policies combine three different, but complementary types of insurance solutions. Each one protects a particular aspect of your business against claims of wrongdoing (or alleged wrongdoing) for any decisions made from the day-to-day running of your business and covers the associated legal costs and any damages paid.

The three elements of management liability insurance are:

- Directors’ and officers’ insurance – covers the cost of compensation claims made against your business’ directors and key managers (officers) for alleged wrongful acts.

- Corporate legal liability insurance – similar to Directors’ and Officers’ insurance (D&O) but offers protections to the company whereas a D&O policy offers protection to an individual.

- Employment practices liability insurance – designed to support businesses in defending litigation claims made by current and ex-employees for alleged breaches of employment law.

Each of these three products is as important as the others. This is because if a claim is made, it’s often not just made against one element. For example, a claim can be made against a director and the business.

Make sure you’re covered for any potential shareholder claims down the line.

Why do businesses need management liability insurance?

The bottom line is that a claim can be made against you, your staff and your business at any time, and they can come from a number of sources. For instance, stakeholders, employees, regulatory bodies, competitors and also customers. Whether that claim is ultimately successful or not, you’ll still face costly legal fees.

As a director, it’s also crucial to remember that your personal liability is unlimited and if someone makes a claim specifically against you, your own assets are at risk if you don’t have adequate directors liability insurance.

Management liability insurance could also cover costs while investigations take place into the origins of a claim. This can help minimise long-term reputational damage, enabling you to get your business back on track.

What type of businesses need management liability cover?

In truth, all businesses can benefit from management liability cover, regardless of size or structure. For example, whether it’s a limited company or you’re a sole trader.

In normal circumstances the assets of the company will determine your liability limits and turnover will be used to determine premium paid. However, if you’re a start-up, we understand that that is not always possible. At Alan Boswell Group, we can help overcome these issues by assessing your business as a whole. This includes looking at how it’s funded, shareholder status and business plans.

We also consider when you’re likely to see outside investment so we can make sure you’re covered for any potential shareholder claims down the line.

Is management liability insurance really worth it?

Policies can’t stop claims from happening, but suitable insurance can minimise the financial risk to you and your business. No matter how ‘by the book’ you or your firm’s actions are, there’s always a chance of misinterpretation.

Protecting yourself, employees and your business

At Alan Boswell Group, we know that liability insurance can be confusing. But our breadth of experience means we can help you to navigate the complexities, and tailor a policy to suit you and the specific challenges unique to your business.

For more information and to explore the wide range of business insurance policies available, head to our business hub or call one of our experts on 01603 218000.